Tuesday Prep

A weak open yesterday got prices below the overnight low (2889.00) for a short while but failed to have any meaningful follow through in the underlying, as evidenced in the NYSE TICK. With weak selling interest the larger time frame bias took control once more, and once again a late rally into the close.

Overnight the range is currently 2900.00-2890.75 versus settle at 2898.25, having weakened recently on the back of news that Trump is going ahead with tariffs on the EU. The hourly below shows the shift up in April’s vpoc to 2895.00 which has also shifted the value area slightly higher overall. If we see a failure to push through 2895 today on any test this could bring more sellers in. However, the larger time frame bias remains bullish so will need to see strong downside momentum and weak market internals to maintain the downside through higher time frame prior support areas.

Zones of interest for today below:

Monday Prep

Friday’s employment report triggered the spike pre-market into the 92-94 zone. Once open there was a brief (failed) attempt to close the range gap from Thursday followed by a very slow, narrow range balancing at higher prices leaving a pronounced distribution between 92-95. This will be a useful frame of reference for today as acceptance above 95 or below 92 could help with directional conviction today.

Overnight so far the range is 2889.00-2999.50 versus settle at 2896.00. The pullback overnight after the initial spike higher dropped back into the monthly value area high, LVN and recent breakout area (see highlighted area below). If we begin to see the market hold inside the value area high for long then this increases the chances of the upside breakout failing and seeing a move back down to the other side of value. Holding above that area keeps the bull case intact for now and targets 2900+.

Areas of interest for today below. With daily, weekly and monthly trends bullish, I’d want to see acceptance below the overnight low/monthly value area high before initiating shorts. A rally into the 2899.25-01.25 zone could see responsive sellers engage and the underlying momentum and market internals will need to be gauged in real time as to whether buyers continue to drive through there or it fails and there’s some long liquidation.

This week’s US economic calendar:

Friday Prep

Yesterday was another low volume day holding higher prices. For the most part it ranged between between the two zones of interest, shown on 1 min and profile charts below. The close at 2882.75 was also the vpoc for the day. A lot of recent sessions we’ve seen a late selling down in the vix and rally in the S&P into the close.

A quick look at the daily below and we can see the market is fast approaching the breakdown point from last October. I’d expect to see a flurry of buy stops should the market push through that area as it approaches 2900.

Overnight the range is 2880.50 - 2889.25, leaving the high weak having retouched Wednesday’s high. Zones of interest for today below ahead of the employment report:

Thursday Prep

Yesterday’s overnight gap higher led to a fair amount of two sided trade in the RTH session, eventually testing the prior day’s vpoc to the tick after leaving a poor high at 2889.25.

Overnight the range is currently 2874.00-2883.00 versus settlement at 2879.75.

My main zones of interest are 73.50-75.25 & 82.75-85.00. Above/below those zones would expect to see breakout potential. Next potential support zone below I have at 51.25-53.75, ahead of the open gap. Above 85.00 could accelerate buying through short covering/new buyers to go through yesterday’s poor high.

Potential news pending re China today as well.

Wednesday Prep

A very slow session yesterday with holiday-like volume at just 850k. Very balanced overall in the upper part of prior session but failing to breakout as there was a lack of fuel from underlying internals and volume. The late move to test the prior and overnight high failed to follow through and saw some liquidation into the close.

Pressure remains to the upside though positioning following the gap higher is going to leave recent longs very vulnerable. For now though, pressure is on the shorts as they are forced to cover on every rally.

Overnight so far the range is 2865.25-86.25, breaking out above the 75-80 zone mentioned yesterday. I’d want to see a clear breakdown and retest fail before considering shorts at the moment and positioning for longs is less attractive up here too - i’d prefer to stay out until more clear to me.

Tuesday Prep

The week opened with a gap higher which steadily continued up to the close yesterday with little give back. Volume was fairly low at 1.2m contracts, especially considering the 29 point range over the whole session.

The daily chart below shows two areas the market is approaching which have a good chance of bringing in sellers, both from a long exit and short perspective. If that area holds this could offer a high reward to risk move for swing trades on a correction back towards the high volume area below. A move up through the CLVA would invalidate the short and put the all time highs back in focus (which i can’t believe I’m saying 3 months after December’s move!).

The hourly chart below shows the monthly volume profiles as well as the composite. The acceptance above last month’s high is clearly bullish (for now), though as mentioned above it’s running into potential higher time frame resistance. Price action remains bullish until proven otherwise, plus shorts being squeezed out can accelerate the move up (though this tends to leave weak structure).

Yesterday’s RTH profile below shows the magnitude of the gap and also the very mechanical way the market moved higher yesterday leaving potential for a cascade of stops to get triggered by recent longs if sellers step in.

Overnight so far the market has ranged between 2864.00-73.50 versus settlement at 2870.50. The split session profiles below show areas of interest today. In terms of potential scenarios today I’m considering most likely. As always, price action, volume, delta and market internals together with order flow give context to any of these:

a squeeze higher into the 75-80 zone where sellers step in and we see some long liquidation and consolidation

a test of yesterday’s high and fail followed by liquidation and test of yesterday’s low and potentially the gap.

a squeeze higher which brings in more strong buying through the 75-80 zone and trends higher

Monday Prep

A look at the daily, 240m and 60m charts below from the month end close on Friday show a strong finish to a very strong quarter.

On the daily we can see that it closed above the breakout area formed from the pullback highs in Q4 last year. Value on a monthly basis has moved progressively higher, and the month finished at the value area high for March. This has been helped in part by the big, fast money in CTA Funds - positioning which, according to Nomura estimates, are all 100% long with ratcheting higher sell levels. It’s adjustments to these types of positions that can lead to the fast downside moves seemingly out of nowhere. Couple that with unwinding of short volatility positions and options hedging and you have the tail very much wagging the dog when things go south.

However, for now, short and intermediate term bias remains bullish from the price action.

Overnight there was news of better than expected PMI number from China (was previously in contraction and now showing expansion again). This helped ES gap higher from the globex open and has so far ranged between 2844.50-2861.25 forming a P shaped profile (often seen with a short squeeze).

The high from Friday was 2840.50 and settle was at 2837.75 - ES is currently trading at 2858 so chances of that gap being filled today are low unless news flow changes sentiment.

I’d prefer to wait and see how this day trades and how the market behaves towards the gap before trading. Some areas of interest below on the split overnight and RTH profiles.

Tuesday Prep

Yesterday was a balanced session overall following the initial test lower and reverse off the 2571.75 CHVN area. Volume was the lowest of the year at 1.19m and the RTH range was equal smallest at 19.00 points.

Overnight has ranged between 2580.00-2600.25 vs settle at 2580.50. The market remains within a multi-day balance following a strong rally. The daily ranges have been contracting and volume has been falling leaving us in a neutral/bullish state on the day timeframe.

Monday Prep

The lowest volume of the year again at 1.1m contracts, there was a failed attempt lower following the move lower overnight, and again a late rally into the close, still failing to breakout higher though. My connection to data is down this morning so am unable to do the zones chart for today.

Friday Prep

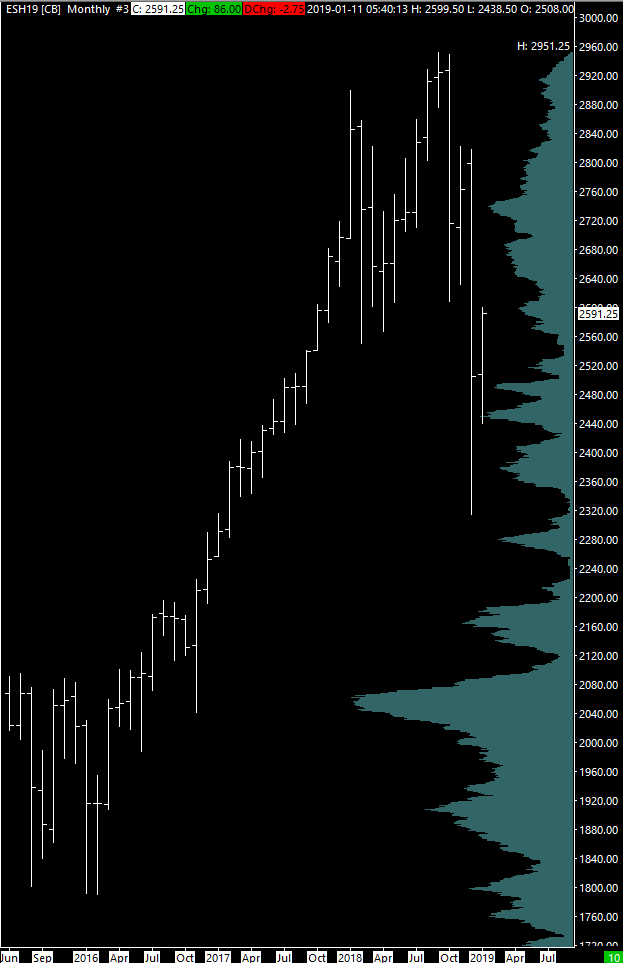

A quick look at the longer timeframes above show:

Monthly - counter trend rally has regained more than 50% of December’s range, though still below the October low at 2607.25 which was month that started the sell-off

Weekly - second week on new highs after sell-off

Daily - 5 continuous higher high days, though on declining volume

If sellers are going to try and get this market back down, this area could attract multiple time frame players potentially as price moves up towards the October lows. It was the breakdown through there that accelerated the December drop.

Yesterday’s overnight sell off left the market vulnerably short, and after failing to push down into the overnight low there was a sharp turnaround higher. The FOMC minutes added to the volatility given Powell’s apparent flip flopping. Buying was strong into the close leaving the VPOC above the prior day’s high. Volume was the lowest of the year though, which doesn’t support the bullish case very well.

Overnight so far the range is 2597.75-2582.50 vs settle at 2594.00. It remains to be seen if we just consolidate/balance today (possibly targeting the 2571.75 CHVN), balance and move higher to test October low or balance/breakdown. We’re looking likely to open inside yesterday’s range currently which can lead to less clean price action.

Today’s zones of interest below: