Friday Prep

A quick look at the longer timeframes above show:

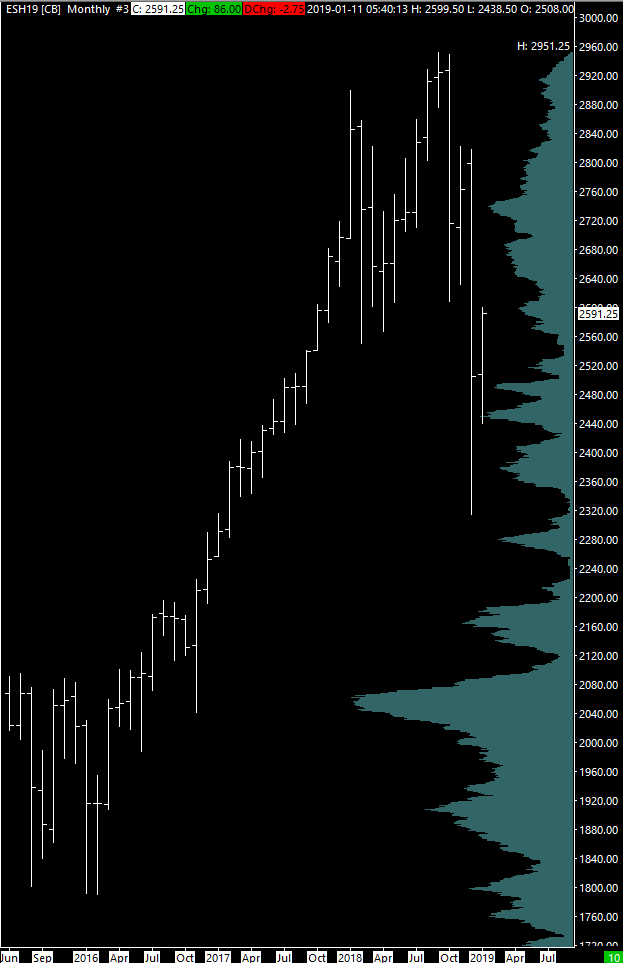

Monthly - counter trend rally has regained more than 50% of December’s range, though still below the October low at 2607.25 which was month that started the sell-off

Weekly - second week on new highs after sell-off

Daily - 5 continuous higher high days, though on declining volume

If sellers are going to try and get this market back down, this area could attract multiple time frame players potentially as price moves up towards the October lows. It was the breakdown through there that accelerated the December drop.

Yesterday’s overnight sell off left the market vulnerably short, and after failing to push down into the overnight low there was a sharp turnaround higher. The FOMC minutes added to the volatility given Powell’s apparent flip flopping. Buying was strong into the close leaving the VPOC above the prior day’s high. Volume was the lowest of the year though, which doesn’t support the bullish case very well.

Overnight so far the range is 2597.75-2582.50 vs settle at 2594.00. It remains to be seen if we just consolidate/balance today (possibly targeting the 2571.75 CHVN), balance and move higher to test October low or balance/breakdown. We’re looking likely to open inside yesterday’s range currently which can lead to less clean price action.

Today’s zones of interest below: