ES Morning Prep

The charts above from left to right show a snapshot of long term to shorter term for ES:

Monthly - April range was 4830.00-5773.25 (943.25 point range!) So far in May we’ve failed to take out the prior high and are heading towards the April close of 5587. The April monthly candle left a 814 point lower ‘wick’, which is a huge outlier and I’d expect to see an attempt to retrace part of this - currently still holding above prior close and above the March low (5509.25)

Weekly - Prior week high 5724.75, low 5455.50 (5590 mid-point). Last week hit the 50 week sma and backed off after a strong thrust higher

Daily - Holding above the 50 day sma (though still trending down) and above the 20 day sma (turning up)

240 min - This chart also has the monthly volume profile with VPOC & value area high/low markers. So far holding above April value area, but pre-market is now holding under the value area low for May (5634 currently)

60 min - This chart has the weekly volume profile overlaid and so far the downtrend overnight is inside the prior week value area; the longer this remains the higher the chance of rotation lower to the other side of value.

Above left above the market & volume profiles for the overnight and cash sessions, above right is the cash session only.

The huge rally has not surprisingly paused and the overnight session has trended lower. In terms of expectations for today, the main scenarios i’m looking for are:

Open to take out overnight low and rally - looking to fade key reference points (vwap, VAH etc.) for continuation lower to test levels. If no rally above overnight low immediately then early push to auction lower prices - 5598-5600 key support zone - looking for more sellers if this fails. Looking for longs to hold if can push back above vwap and vah for today

April 15th Review & Plan

After a 5 year hiatus in publishing a daily note, it’s about time I restarted! We are in one of the greatest trading opportunity years in history, but to take full advantage of this we need to be fully prepared for the uncertainty we will face each day.

Top down Charts:

Monthly - one time framing lower (943.25 point range so far in April). March low 5509.25, April low 4830.00. Has retraced 50% of Feb high to April low.

Weekly - inside prior week 5528.75 high, found support at CLVN 5391

Daily - balancing inside prior day, range narrowed significantly with volatility dropping sharply

4hr - holding up upper end of value area, balancing

1hr - balancing above prior week value area high, contracting before next move. Prior week VPOC 5400

Thursday Prep

Review

We saw a lot of two sided trade yesterday leaving a range bound day above the upper half of the prior session. Post FOMC we saw liquidation and after hours the FB numbers drove futures further down, along with increased negative sentiment relating to coronavirus. Volume was significantly lower than we’ve seen in the past few sessions.

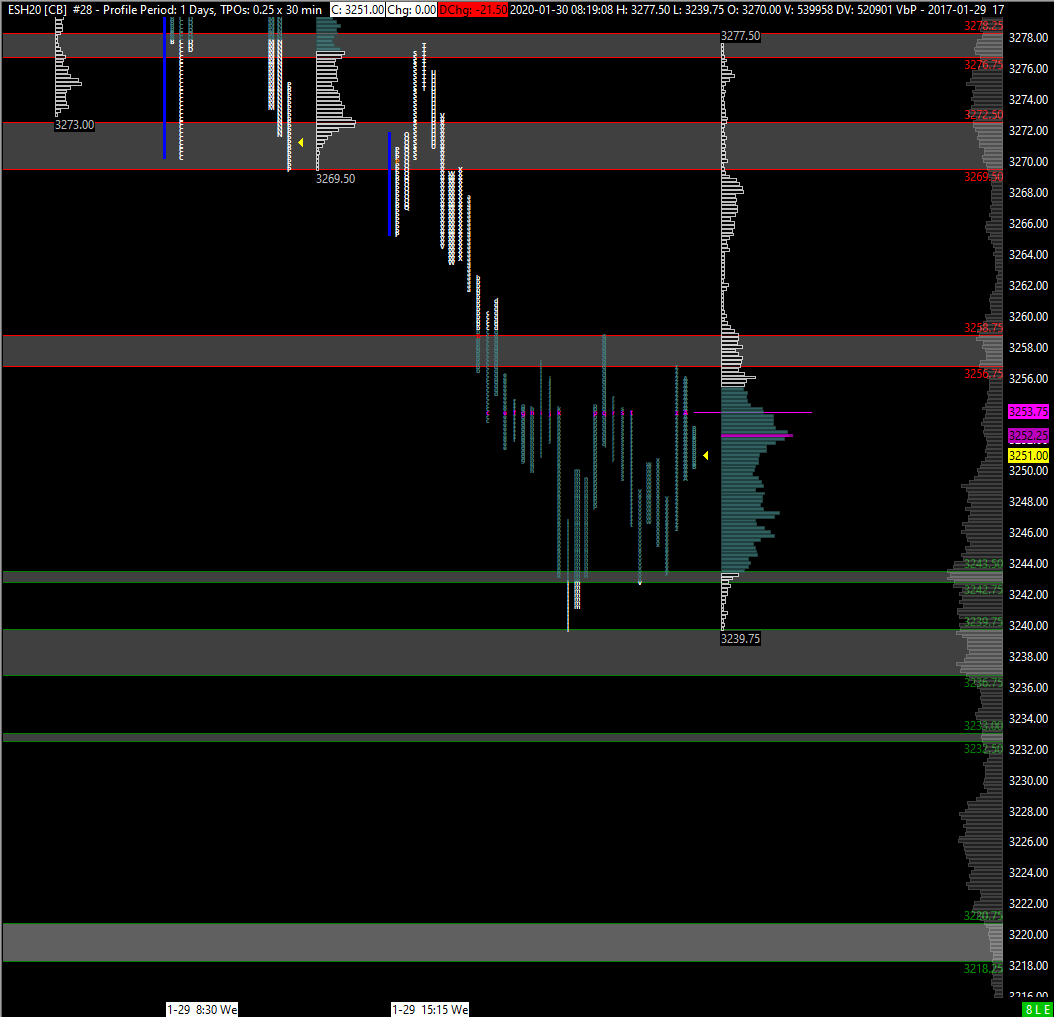

Overnight the range is wide, trading between 3277.50-3239.75, versus last nights settle at 3272.50

The market has developed a range within a larger range, as highlighted on the daily chart. Looking for responsive action within the smaller range, but on alert for a break from this balance area. Today’s zones of interest below on the split profiles

Wednesday Prep

Review

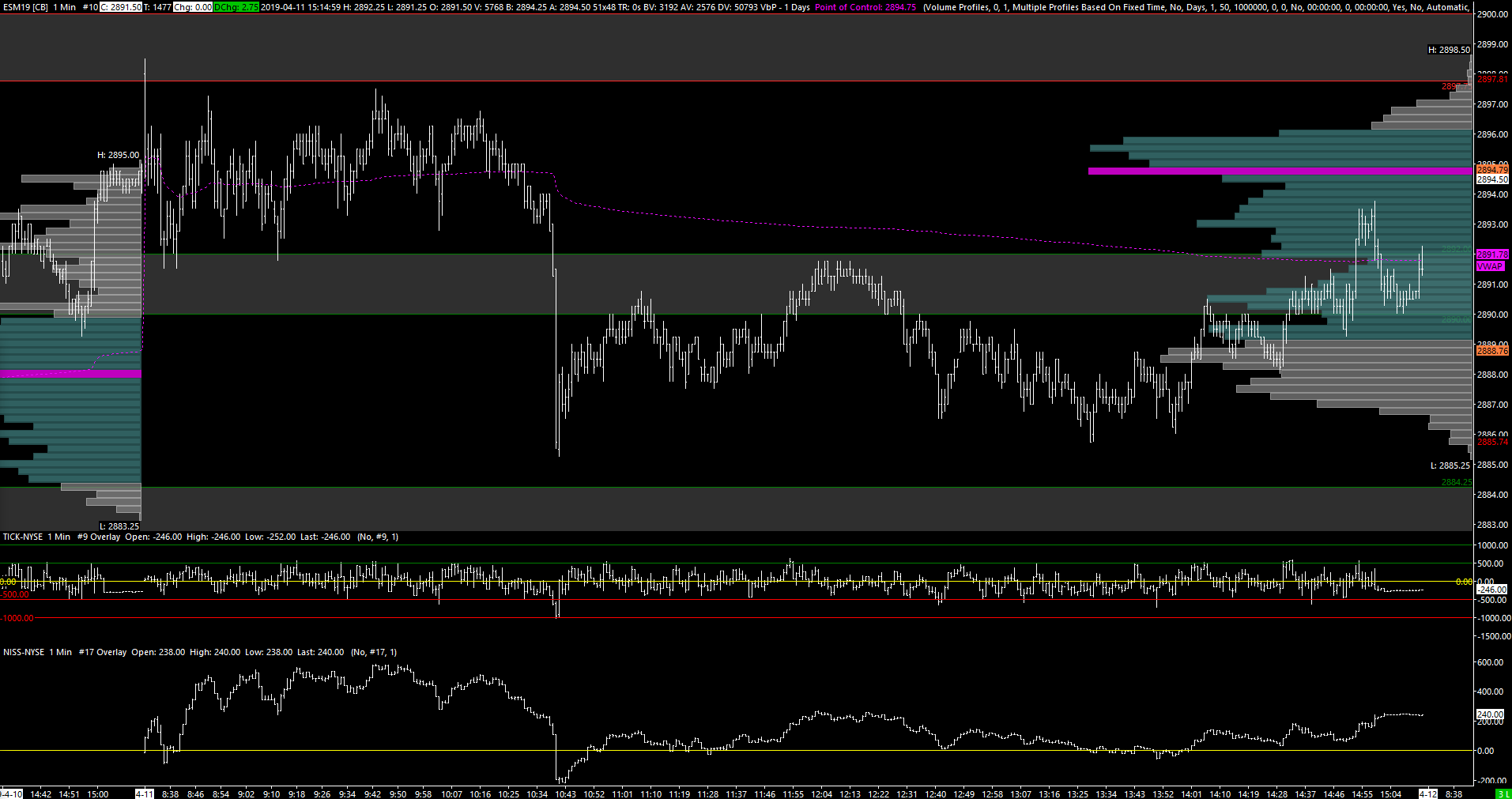

Yesterday’s opening action gave us a strong clue to at least refrain from the short side, because of the lack of momentum in the underlying stocks (using NYSE TICK). This created a great long opportunity for the gap close target. There we also good tradeable reactions off the red zone, with momentum weakening into that area (see above).

Overnight the range is currently 3273.00-3291.75, overlapping higher to yesterday’s range, helped by strong numbers from AAPL after hours.

The immediate overhead targets are the 3293.25-95.25 zone (Friday’s settlement and VPOC) and then the 3299-01.50 zone (composite low volume area).

Below are the 3276.75-78.25 (yesterday’s settle and VPOC) and 3272.25-73.25 zones (overnight low, prior LVN, prior afternoon swing low & initial balance high). If sellers break that zone there’s a strong chance of a flush lower into yesterday’s single prints etc to test the 3256.75-58.50 zone

Tuesday Prep

Review

Yesterday’s cash session opened inside the initial green zone on hugely negative NYSE TICK and flushed through the overnight low quickly but reversed just as quickly back through the opening price creating a short squeeze on an already extended downside overnight. As highlighted above, the initial red zone was a confluence of the London open swing low and breakdown point later in the morning. Volume was high at 2.7m contracts.

Today the overnight range so far is 3238.75-3263.75, still inside yesterday’s range. I’m looking to avoid trading in the middle of this range as could easily get chopped up, but instead wait for opportunities around the edges if it looks like a consolidation day, or look for pullbacks on trending moves.

This is my first week back trading ES after a long break, so I’m better off being patient and get into the flow of the market gradually. Trying not to let any opinions about the coronavirus outbreak is difficult but ideally be guided by what information the market is giving. My gut feeling is this could escalate into something major which in turn would push the over extended and heavily index positioned market over a cliff, and be a proper test of market liquidity. However, we could see some very aggressive rallies ahead of that so will try to let go of any news bias. FOMC tomorrow as well just to throw in the mix.

Zones of interest today are:

Monday Prep

Overnight sell off into the monthly VPOC

After last week’s data and platform fail, I’m hoping all issues are now resolved. It’s very rare I get any issues with either so was lucky not to have any positions on.

The risk off sentiment following the coronavirus outbreak has seen ES give back most of the month’s gains. Overnight action drove prices back to the Jan VPOC at 3237.50. There has been some short term support there, though ES is now trading back inside December’s range.

Friday’s settle was 3293.50 after dropping 32.50 points on volume of 2.4m. The overnight range is currently 3269.75-3235.75, gapping sharply below Friday’s low. The size of the gap makes it less likely to see that filled today (without a majorly positive news catalyst).

The two main scenarios I see that have potential for today to be ready for:

Attempt to rally through overnight range and into gap, squeezing weak shorts out before attracting new selling

Continued weakness after open, failing to break above overnight vwap and pushing down into the January VAL to find buyers

My green zones of interest for today are: 3218.25-3220.75 & 3235.50-3238.25 and red zones are 3257.00-3259 and 3268-3270. Above 3270 it’s into the gap and there may be a squeeze up to 80.50

Tuesday Prep

Not a great start to the first day back as my data feed is throwing my intraday charts out completely. However, using the regular trading hours profiles gives enough to eyeball the zones of interest for today.

The initial green zone represents the most recent volume & time consolidation ahead of a spike (from 16th). Will be looking at momentum and trade flow in this area for signs of absorption if looking for a bounce. If we see heavy selling through that zone will be looking for signs of responsive selling on a bounce back up to target the next zone below through the gap.

2020 Reboot

My apologies to long time subscribers of the blog; It’s been 9 months since I last posted a pre-market note on ES. The regular habit I’d built over several years slipped and before long a week off turned into total neglect. The knock on effect of this was unprepared trading and then no trading at all for some time. This key daily routine kept me in tune to the market and built contextual awareness day by day. Failure to keep that habit up has been detrimental, so time to get back to it again and make this year one of productive habits and process.

Accountability is a powerful thing, and this should create a positive feedback loop to produce better analysis, win-win. The key thing is to have done a thorough preparation to the trading day and review what was done at the end - the bookends, if you will, to the process in between.

Emails are the bane of most people’s digital life, so I don’t intend to send out an additional email at the end of the day. I’ll be adding a website notification option this week which should get round that issue. I’m also considering using a Slack channel for those interested, and/or a trade review. Please can you vote in this poll to give feedback on this.

With today being MLK Day and the cash markets closed, it’s a good opportunity to review the market. A look at the monthly, weekly, daily and daily cash hours charts below all paint a very similar picture. However, the cash chart also shows the many gaps left on this relentless, low volatility rally and bull trend.

A closer look at the most recent RTH profiles shows the nearest gaps and untested VPOC/POCs. This has left weak structure below in the near term, which can be seen as single prints, gaps and thin parts of the volume profile.

Friday’s prominent point of control will be pivotal for short term bias and momentum, though any major change in trend is going to need to take out this month’s low first, which is at 3181.00. Failure to break through the 3324.25 POC could be a sign of weakening momentum and could lead to a downside test of the gap and single prints below.

I’ll do a pre-market prep tomorrow with zones of interest for the day, as usual.

Looking forward to picking up where I left off and building on it. Let’s kick some a$$ in 2020!

Monday Prep

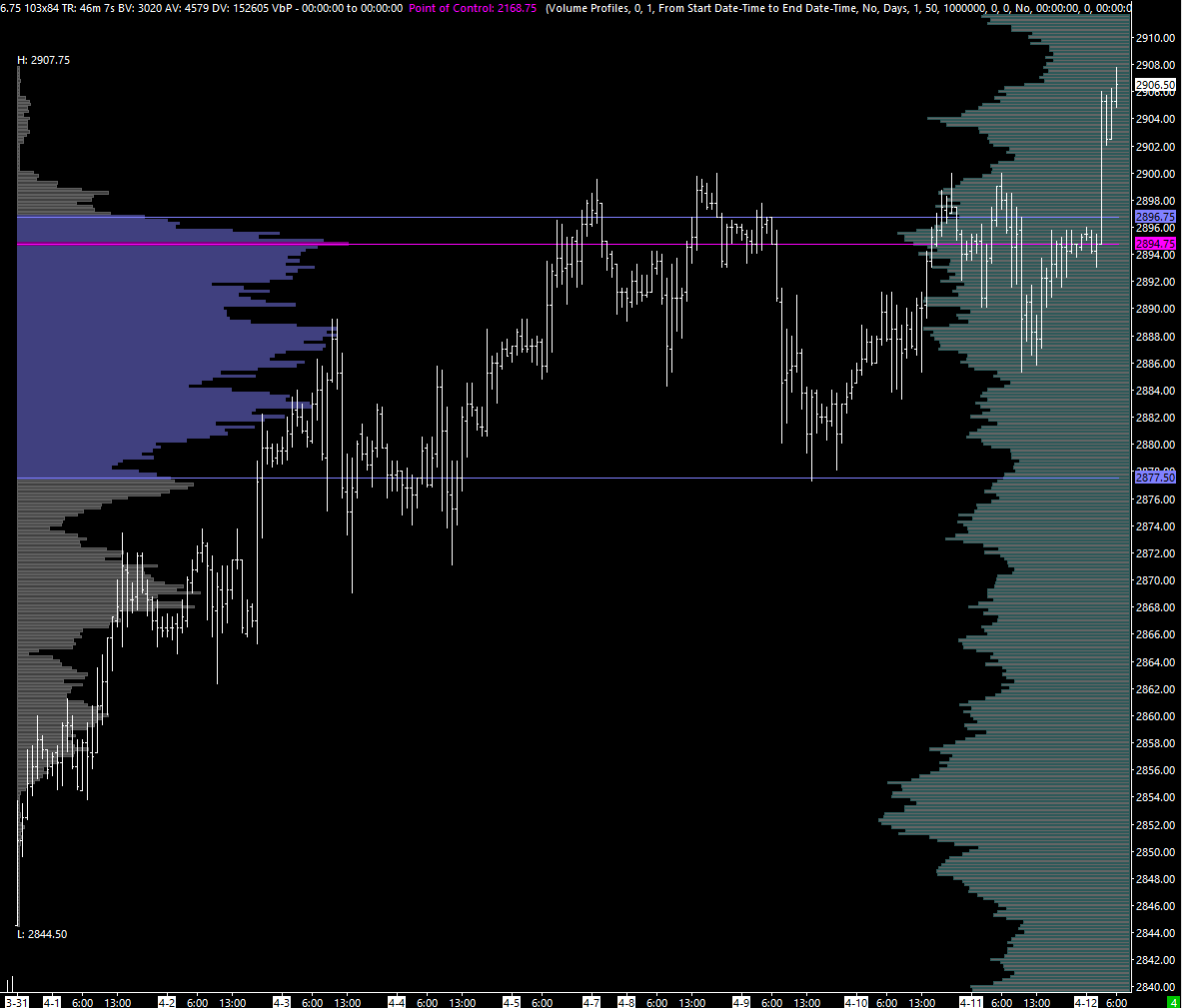

The strong kickoff to the Q1 earnings season in the financials pre-market on Friday gave ES the strength to fly through 2900, after many failed attempts this month. The gap wasn’t closed intraday but instead pulled back from one of the measured target zones into the overnight pullback area following the initial pop higher. Another strong close left settle at 2912.50, at the top of the day’s value area.

Overnight so far the range is 2909.25-14.50, the smallest we’ve seen for some time. If the 2907.50-09.25 zone can hold when tested, the main expectation would be for attempted continuation. If that zone breaks and becomes resistance then we could be setting up for a gap fill attempt and balancing. A complete reversal would be the least likely unless we get some strongly negative headlines on the ‘ we’re nearly there on signing’ trade deal, for example. GS have reported pre-market and trading down a few points ahead of the open.

Zones of interest for today below. The 2900 level is an obvious one of course and relevant to option open interest. If prices start to accept inside 2900 it’s likely sentiment has turned and potentially rejected the breakout.

Friday Prep

Yesterday’s RTH session opened and balanced for the first couple of hours above the prior day’s value and looked poised to break above 2900. However, a headline driven break saw longs flushed out and a lower distribution was formed for the rest of the day. Very little give back still with buyers stepping in on every dip.

Overnight has seen stronger than expected Chinese data , a bid for Anadarko by Chevron and stronger than expected Q1 results from JPM. ES broke through 2900 (on it’s sixth attempt this month) and has broken out of the balance range it’s been stuck in. The range so far is 2890.75-2908.75 and trying to push higher versus settle at 2891.75. There are no major US economic numbers today but financials likely to be the lead. Zones are the same for today - again, upper zones are target areas not necessarily spots to fade. I’d want to see a real shift to negative internals/momentum etc before fading this.