Friday Prep

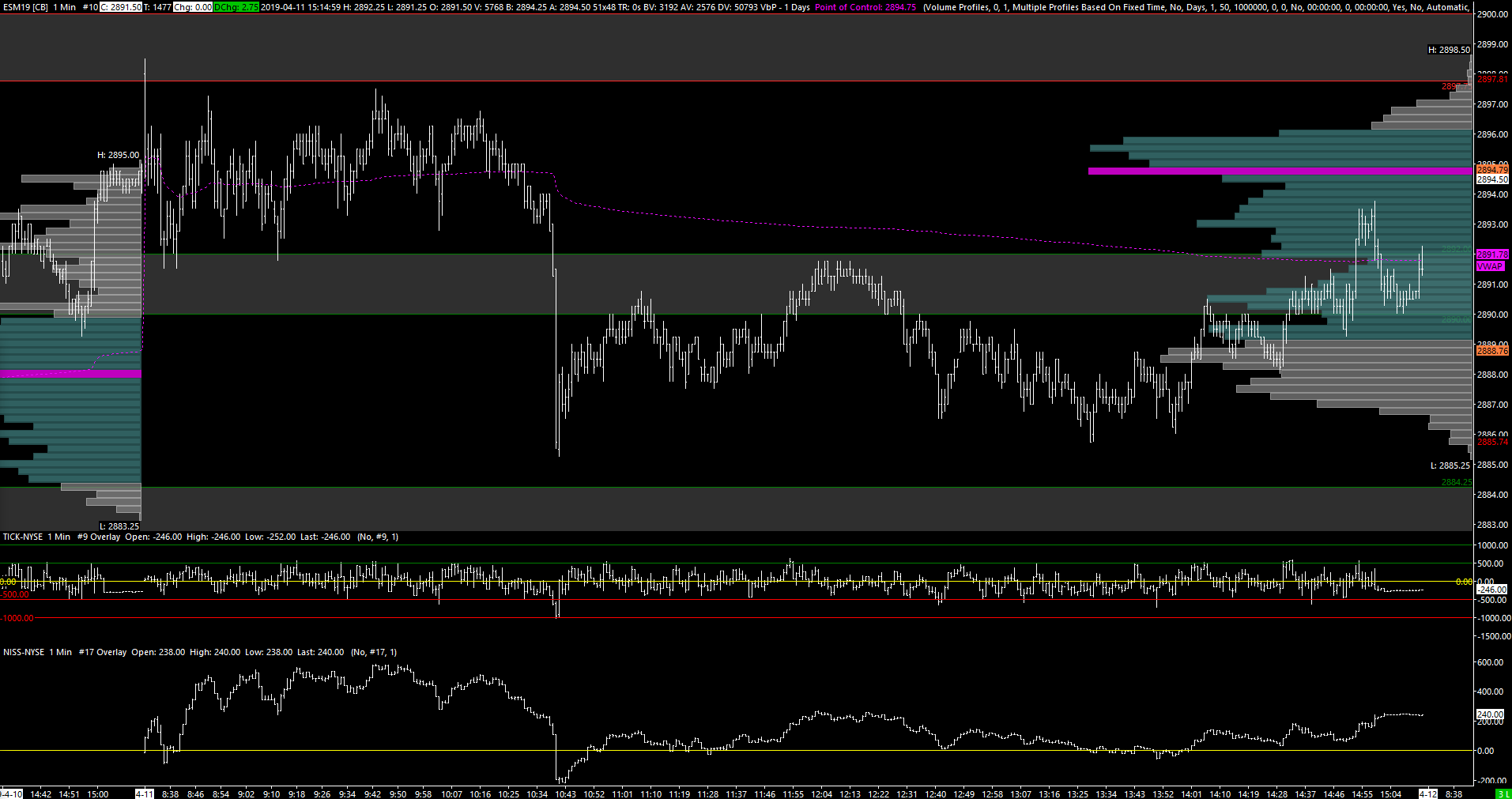

Yesterday’s RTH session opened and balanced for the first couple of hours above the prior day’s value and looked poised to break above 2900. However, a headline driven break saw longs flushed out and a lower distribution was formed for the rest of the day. Very little give back still with buyers stepping in on every dip.

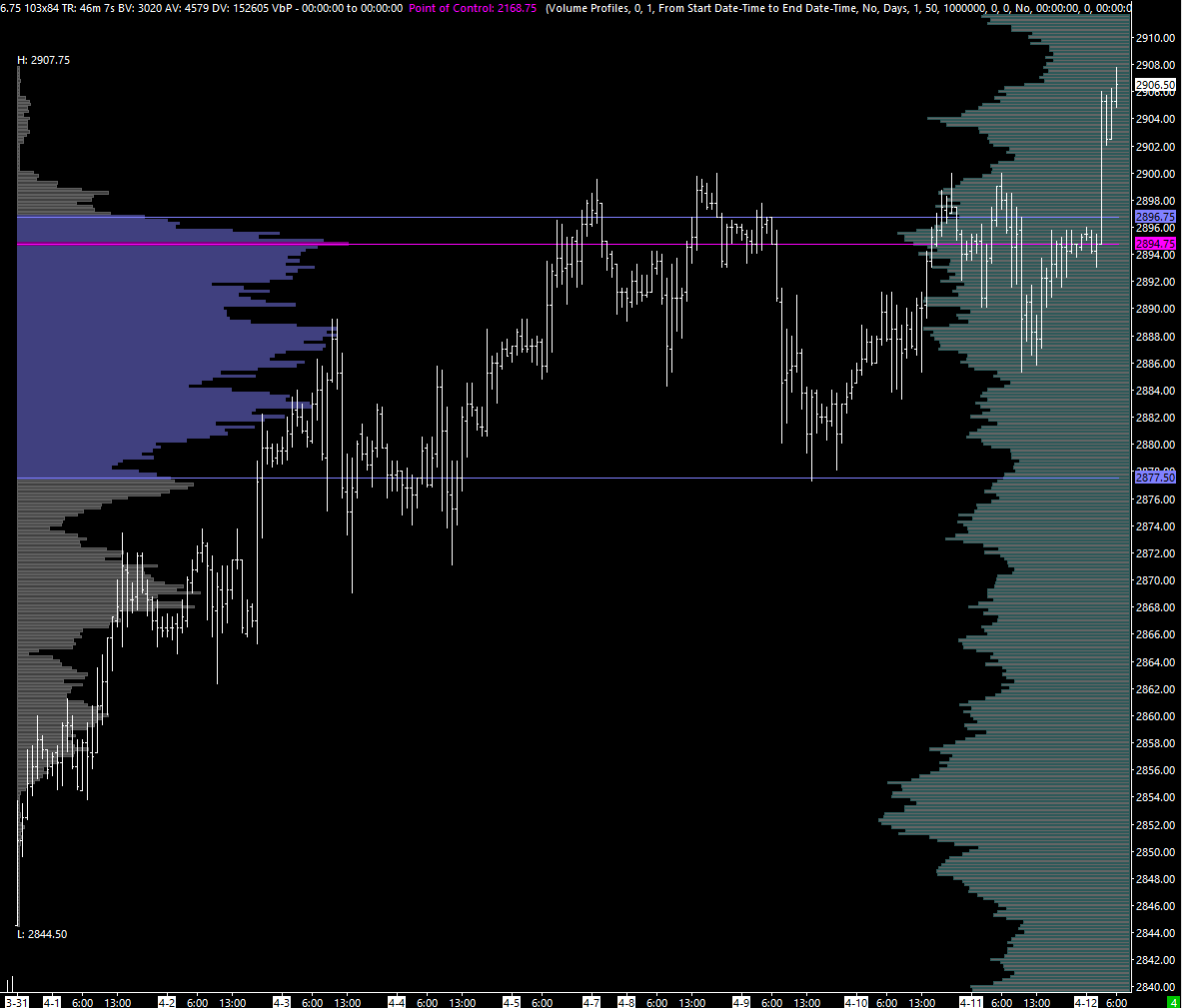

Overnight has seen stronger than expected Chinese data , a bid for Anadarko by Chevron and stronger than expected Q1 results from JPM. ES broke through 2900 (on it’s sixth attempt this month) and has broken out of the balance range it’s been stuck in. The range so far is 2890.75-2908.75 and trying to push higher versus settle at 2891.75. There are no major US economic numbers today but financials likely to be the lead. Zones are the same for today - again, upper zones are target areas not necessarily spots to fade. I’d want to see a real shift to negative internals/momentum etc before fading this.