Thursday Prep

Wednesday’s zones

Yesterday’s move to the high of the year so far was also on the lowest volume of the year in ES at 1.54m. The morning move higher failed to have strong internals behind it and there was divergence in the advance/decline line early on. The mini liquidation break moved down to test the composite high volume area mentioned yesterday and failed to bring in more sellers once down there. Price regained the bullish tone leaving value once again higher, but failing to breakout to the upside.

Overnight so far the range is 2583.00-2560.50 vs settle at 2582.50. At time of writing price is trading around 2570.00, which is now the key composite high volume node in this range (CHVN).

Zones for today on the split profiles below. With price trading inside multiple days, action could be choppy until there’s a more definitive break one way or the other. Dominance above/below the overnight range will probably be the clearest signal.

Wednesday Prep

Tuesday’s zones

Going into yesterday’s open there had been a strong rally leaving the market about 26 points from the prior close and up against a potential resistance area. There was a steady sell off into the overnight low but downside momentum was not that strong, and advance/declines was still around +500 at the prior settlement. This was a cautionary signal not to get too bearish into a potentially strong support zone.

Once priced could hold above the prior day’s high, a bigger volume distribution built as buyers bought each dip leaving the vpoc at 2574.75.

Overnight has ranged between 2568.50-87.25 vs settle at 2572.50 as the market narrative gets steered back to China trade talks with an official statement expected tomorrow. The overnight profile looks poised to break higher as value builds above yesterday’s value area and high.

Initial potential support and resistance zones I have at 2570-73 and 2589.25-93 respectively. Any break higher will need strong market internals to maintain or risks failing, particularly if opening above yesterday’s high. Overnight support zone I’m using as 79-82.50. The zones above 93.00 are target areas and these may or may not offer resistance depending on market internals and context.

Tuesday Prep

The charts above are the regular trading hours (RTH) of the market & volume profile (left) and 1 min with NYSE TICK & Advances/Declines with vwap (right).

The profile shows another spike of single prints once the prior day high was broken. This leaves several days with single prints recently which signal fast, stop run activity. I’d expect to see these revisited at some point. The upper zone which yesterday’s high pushed into was from a breakdown area on Dec 18th.

The 1 min chart shows strong momentum in the TICK early on and strong market breadth in the A/D line. When the price was close to the prior settlement in the first hour, the A/D had climbed to about 1200 with positive TICK momentum, which was a good sign the rally had legs. A/D isn’t always this useful but because the number is calculated based on the changes from the previous close, this was potentially significant i.e the net 1200 advancers showed the broad market was strong but price in ES hadn’t caught up as it was still at the prior settlement level. Once the high was in, there was a shift in TICK momentum and move back to vwap.

Overnight has continued higher, with the range 2549.25-72.00 vs settle at 2550.50. Using back adjusted data, the low from Feb 6th ‘18 was 2549.00 which is a significant area to hold above/below in my opinion for this rally to continue/fail. Momentum remains in longs favour for now, and I’d look for pullbacks to get bought within the overnight range but below 2549 I’m looking for price to slip lower quite fast potentially.

Today’s zones of potential support/resistance:

Above:

2567.50-72.00

2579.00-81.25

2589.25-93.00

2622.75-26.25

Below:

2559.50-61.00

2548.50-51.75

2539.00-40.25

2532.50-34.50

2520.50-24.75

Monday Prep

It’s been a long break since my last post and markets have been giving traders some phenomenal opportunities if prepared and able to take on the elevated volatility; it’s certainly not for everyone. As the game evolves, so do the rules of play.

I’m not going to get into the fundamentals in this post as the main aim of the note is provide a technical framework and objective overview of the short term structure, as it relates to intra-day futures trading. However, I will include a more macro fundamental perspective as a weekly note in future for those who are interested.

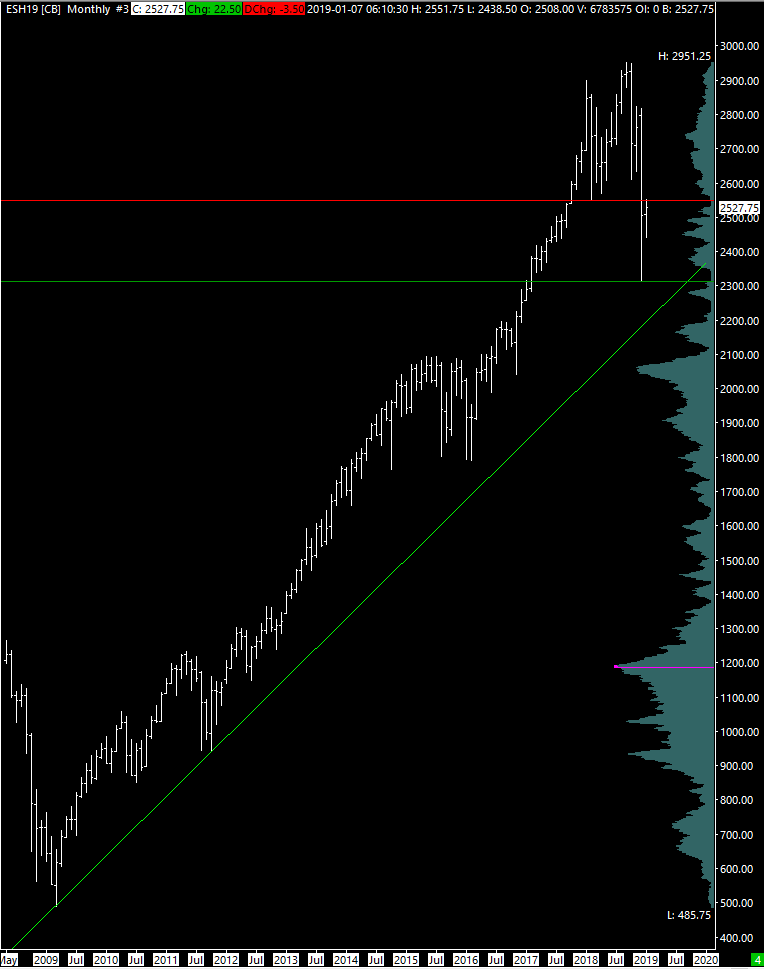

Above we have the monthly, weekly and daily charts for a long term perspective. The counter-rally we’re currently seeing against the monthly downtrend (within a multi year uptrend) is running up against a key area from last year i.e. the Feb lows. You can see an area of low volume (highlighted on daily chart) which could attract longer term sellers. However, short term, both sides will be active and buying was strong on Friday on the latest narrative led move.

Overnight began with a strong rally higher which reversed off the Feb ‘18 low area and moved back down a tick above the Dec 28 swing high. The range is currently 2523.25-51.75 vs settlement at 2531.25

Momentum and market breadth will need to be strong to continue the rally i.e. positive TICK, A/D and cumulative delta.

Overnight support zones at 2527.00-28.25 & 2520.50-23.50. Holding below the overnight low could see a revisit to Friday’s single print area or lower. However, would expect to see a buying response at the 2499-2501 zone on first test.

Overnight resistance zones at 2537.00-41.75 & 49.00-52.50.

Zones for today below:

Wednesday Prep

The lack of downside pressure after the open saw a wide and fast first half hour (nearly 40 point range). This move was a bit too far, too fast and price action was poor for several hours until buyers regained dominance in the afternoon, pushing to close near the high.

Overnight has kept the upside momentum with the range currently 2682.00-2714.00 versus settle at 2685.50. At current price the market is looking to open on a large gap of approximately 20 points. This will add to pressure on short positions from the last few days and could cause a rapid squeeze in price (next target 2728 CHVN). Whether we see an early attempt to close the gap or just a fast move higher will help determine what type of day we’re likely to see. The least likely expectation is to start trading back inside yesterday’s range, but if that occurs all longs from overnight are offside. Zones of interest for today below:

Tuesday Prep

The early failed breakout above the prior day’s range saw a complete reversal of the overnight move and once below the overnight low things accelerated on the downside with about a 60 point drop followed by a 40 point bounce over the last hour and a half. The extreme TICK readings on the downside indicated some aggressive liquidation going on.

The strong buying tail left on the day will be a useful guide today as if this is going to be an intermediate swing low I’d expect that tail to hold. Therefore I’m using the 2624-28 area as a short term bull/bear zone.

The market overnight has so far ranged between 2636.25-64.25 versus settle at 43.50. If the market can hold above yesterday’s settle then there’s scope to reverse yesterday’s move and squeeze shorts. Zones I’m watching today below:

Monday Prep

Friday ended up a fairly balanced session within a wide range. The push lower into the 25.50-29.75 zone saw selling dry up and there was a 65 point reversal over the next two hours.

Overnight the market has been strong, led by European indices. The range is 2660.00-2700.75 versus settle at 2669.50.

If prices can hold above Friday’s high then the next major target is the 2728.00 CHVN. Failure to do that would put Friday’s settlement and vpoc as immediate targets below.

Friday Prep

Yesterday’s open tried to move price back to settlement but underlying stock momentum was positive and the down move was short lived. The rally cleared the overnight high and found support there before an attempted move back to the 2728 CHVN. The move fell short of there and had a fast liquidation drop into the close. The after hours results from AMZN and GOOG have led the weakness overnight with nearly an 80 point range from last night’s high to the overnight low.

The overnight range is currently 2690.00-2646.00 on above average volume. The move below Wednesday’s lows is going to be an important pivotal area today . Acceptance below there keeps the pressure on the downside. We've not really seen any panic selling yet and we may not until the February lows get taken out. That’s still around 100 points below here which could easily be done in a day or two at current volatility. At that point if there’s no follow through below the Feb lows there’s room for some very aggressive rallies. In the meantime, a lack of downside momentum is likely to see buyers try to move back to the 2728 CHVN.

Keeping a close eye on NQ today as likely to be in the driving seat as AMZN is roughly -10% pre-mkt.

It’s the lack of downside follow through and momentum that can enable the big turnaround moves. However, in the absence of any majorly positive news today the main expectation is for sellers to step in on rallies and try to hold below Wednesday’s low.

Today’s zones of interest:

Thursday Prep

The caution going into yesterday was whether or not a move back to the CHVN at 2728.00 would either find support or fail and potentially trigger a liquidation move. The eventual break of the prior day’s low on the second attempt (after bouncing to the vpoc on the first try), really accelerated the move, dropping about 40 points in the last hour.

Overnight so far the range is 2658.75-92.50 versus settle at 64.25. The overnight high is at an important area for bulls to push through if there’s going to be any chance of a reversal. Failing to break that could leave the market balancing in the lower half of yesterday’s range or try to extend lower. The after market earnings today from AMZN & GOOG and how the Nasdaq responds ahead of that are going to be hugely influential later in the day particularly.

My main expectation is for some consolidation in the bottom half of yesterday’s range with an attempt to test the lows. A failed breakdown could lead to a very aggressive short covering rally, as could a hold above the overnight high could target the 2728.00 CHVN. Any breaks lower are going to need broad market participation and momentum to be sustained.

Zones of interest today:

Wednesday Prep

A quick look at the monthly, weekly and daily charts above puts things into context and as we can see from yesterday’s move on the daily, the market tested the lowest volume area at the bottom of the major volume distribution on the composite profile.

Yesterday’s open at 2715.50 was a 41 point gap below the prior settle. In yesterday’s note I stated: If there’s an early move back to the overnight vwap in the first hour, it could be telling whether that holds or not to the ongoing action. The 24 hr vwap was at 2723.25 at the open and the initial move higher stalled and reversed at the vwap to make the eventual lows on the day. The heavily short and extended move got aggressively bought for the rest of the session and eventually closed the range gap from Monday. Volume was heavy at 2.8m contracts.

Overnight so far the range is 2719.25-50.00 versus settle at 2746.25. The in-range composite high volume node (CHVN) is at 2728.00 which could become a magnet on a failed move higher towards the 2750-52 CLVA. Pushing through and holding above 52 puts 71 as next target. Failure for 2728 to hold puts yesterday’s reversal into question and could trigger a liquidation move lower.

Zones of interest for today below: