Tuesday Prep

Yesterday opened at 2321.00 vs the prior day low at 31.75 and settlement at 44.75, leaving a large gap and shorts sitting on decent gains. The failure to take out the overnight low by 1 tick was the first evidence that shorts could start to cover.

The 2 min chart below shows reactions at yesterday's zones. We got acceptance back above the bull/bear zone. Clear reaction on first test of the 40.50-41.50 and support at the B/B before another attempt to break resistance before the close.

Overnight has seen a range between 2334.50-44.00 so far, having sold off from the highs since the European open. I'm keeping the bull/bear zone the same and if that continues to hold I would expect further balancing within the upper range of yesterday or another attempt to squeeze shorts above yesterday's high. If the market starts holding below 31.75 then sellers are likely to be active looking for a break down again.

Today's zones below for today:

Monday Prep

Apologies to my regular subscribers for the extended break in service, I've been renovating my house for the past few weeks and living in a building site, but I'm finally back to some normality again!

The weekly chart below also shows the monthly profiles. Although March so far remains inside of Feb's range, we've seen a downtrend begin on the weekly candles as trade re-enters the thinly traded 2290-2230 area.

The daily chart below shows continuation from the impulsive move lower last week and the short term balance of the past few days. It's also the first time the market has held below it's 50 day sma since before the election. The next major area to test below is where the market broke out in Feb, around the 2290-95 zone, and then the low for Feb at 2277.50.

The break lower overnight has left initial resistance at 2331.50-33.50. Acceptance back above that zone will trap shorts from overnight and could see a move back towards Friday's settlement at 2344.75. It remains to be seen if we are going to get more of a reaction from the healthcare vote failure on Friday and have a bigger liquidation - I would expect it to, however, if overnight inventory has got too short we may see a correction to that before sellers step in again.

So far the overnight range is 2317.75-37.50 on above average volume, along with a drop in the dollar, bond yields and crude. In terms of trend, the monthly is neutral and the weekly and daily time frames now bearish.

Zones I'm using for today are below, with the short term bull/bear zone at 31.75-33.50. Holding below 31.75 increases the chance of further liquidation to test the breakout area from last month. Holding back above the bull/bear zone puts the market back inside last week's balance area where we could see responsive sellers step in at the zones above.

Thursday Plan

The overnight range has so far held above yesterday's IB high (89.25) and the market remains strong above there. If there is a break through the overnight low then I'm waiting for the 81.50-82.75 zone for potential longs, depending on market dynamics at the time. The resistance zones marked are not areas I want to short necessarily, more pause points on a move up.

After yesterday's breakout my main expectation is for higher prices to hold and potentially extend yesterday's range or to consolidate within yesterday's range. The least likely scenario I see would be for yesterday's gap to fill in today, given its magnitude.

Wednesday Review

Following Trump's speech we've seen a relentless bid under the market and a near parabolic squeeze higher. The near 40 point full session range yesterday saw cumulative delta peak around +75k into 2400. Short exposure being covered has accelerated the move higher leaving a large range gap in RTH, well above the February VPOC at 2362.25.

Overnight there's been a slight drift lower, with the range currently 2389.50-94.00. Yesterday's overnight high at 82.75, 50% pullback of yesterday's full range at 82.25 and yesterday's open at 81.50 is the initial anticipated support zone. Yesterday's market profile left a poor high at 2401.00, likely a function of short term traders getting overly long into the highs.

Buyers remain in control and shorts are vulnerable to a further squeeze while the market holds above yesterday's initial balance high at 89.25 and a re-test and potential follow through of yesterday's high would be on the cards.

If 89.25 fails then initial support at 81.50-82.75 would be the next expected buyers response zone. Acceptance below initial support leaves the open gap to test.

Zones for overnight:

Tuesday Plan

Overnight

The market has held a tight range between 2365.50-68.75 so far on light volume ahead of several important numbers.

Overnight support 64.75-66.00 Overnight Resistance 68.75, 70.00-70.75

A fairly business calendar today (times CT) with Trump's speech to Congress this evening which could trigger a big move in Globex tonight.

If overnight support can hold then it's a fairly easy run up to new highs. For the past two days we've seen aggressive buying into the close, both around 30k cumulative delta. A break below the range vpoc could see a test of yesterday's range or break lower trapping recent longs

Monday Review

Review

The bullish bias continued yesterday with the market opening above the prior day's value area, briefly testing lower and then making a move for the overnight high. There wasn't sufficient strength to continue the move, but it held up, settling at 2168.25. Volume was low at 1.1m contracts.

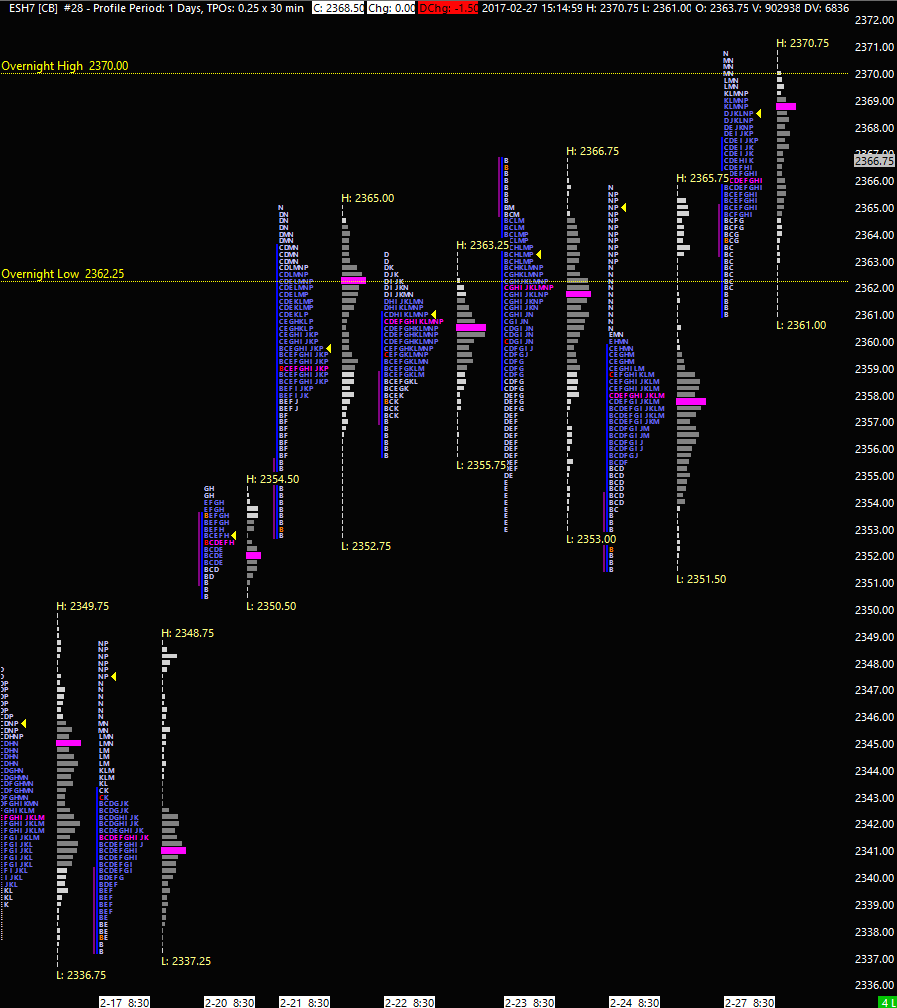

The daily RTH chart below has the monthly volume profiles which shows the current balance area between the 2350-70 area, with a VPOC at 2360.50. This is a pivotal level and for the short term bullish bias to continue in alignment with the longer term, I want to see the market holding above there.

Friday Prep

Europe has been weak overnight, pulling ES below yesterday's lows. I'm using 2353-55 as the bull/bear zone for today. Yields are down sharply in the long end with the 30yr back below 3%, currently 2.99%.

If we see acceptance below 53.00 then there's a good chance we could have a liquidation break down to last week's value low (2332.50). However, the overnight move has been driven by Europe and depending on market breadth and momentum after the open there could be a short covering rally if the 53-55 zone is regained.

The support zones shown below are all valid response areas in line with the longer time frame bullish bias but order flow and market internals will need to be watched carefully for signs of continuation lower or not. A squeeze higher above the bull/bear is likely to gravitate to the week's vpoc area at 59.50-61.00, where the market broke down overnight. Above there is potential for a further short squeeze back towards the highs again.

Thursday Review

Yesterday's failed breakout and brief liquidation stopped in it's tracks at Tuesday's open, 2353.00. The day balanced from then on and left value overlapping higher to the prior two days and settling at 2262.75, +1.75pts and volume of 1.5m

RTH Daily with Monthly Volume Profiles & 1500 day composite

The breakout at the open failed and the liquidation move lower failed to hold the 54.50-55.75 support zone and just touched the zone below. The drop left a lot of single prints early on and without continuation to the downside the odds are good that these are at least attempted to be closed intra-day. We eventually saw a move back up to initial resistance late on and then back to vwap for the cash close.

Wednesday Prep

Having been away for the past couple of weeks I've missed the continued melt up in the stock market. The move has left gaps and weak structural support should there be a correction (note that the VPOC for Feb is currently 60 points away at 2288.00). A major negative news event could have it back down there a lot faster than it rose. However, there's no sign yet of an end to the upside auction and short sellers have added fuel to the move as they are stopped out.

The zones for today are below based on the last two weeks price action and profile structure.

Wednesday Review

The market opened below the prior day's low and failed to hold the initial support zone. This had potential for a move back into last week's balance, but the break down was weak and sellers failed to keep momentum going. The NYSE TICK was also very neutral with the move, not supporting a continuation.

Once back above support there was a slow grind higher, with a pullback to vwap, until touching the top of the initial resistance zone near the close.

We could see continuation higher above IR overnight to squeeze shorts though without any momentum the VPOC of the past few days is at 2288.00 which may be a short term magnet. 85.25-86.25 is now initial support for the globex session.